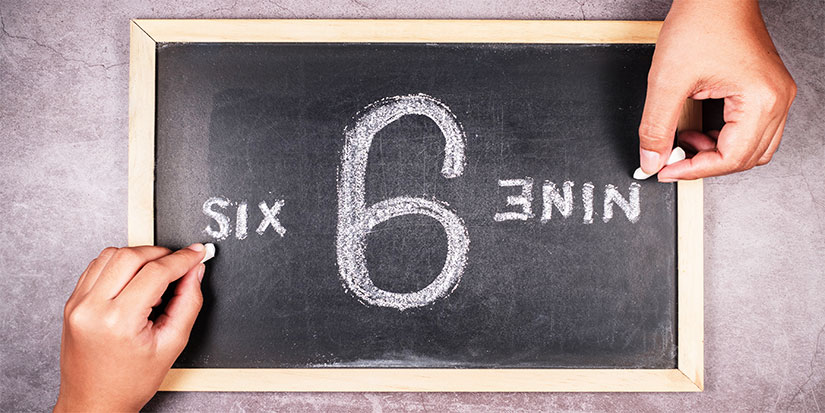

A Matter of Perspective

Things are pretty good right now. But I think most experienced market practitioners know that pain could be just around the corner.

How Much Pain Can You Take?

Let’s say you hear that the stock market is pretty hot, so you decide to start investing tomorrow. As luck would have it, tomorrow is the high in the stock market, and we get a 10% correction, followed by a 20% bear market, followed by a 30% disaster, followed by a rare 50% great bear market. You invested $50,000, and now you have $25,000.

How does that make you feel?

Well, you probably feel pretty dumb. You probably think you are bad at investing. You probably feel like a sucker. You probably also begin to think that the stock market is a giant casino and is unsuitable for investment. And so on.

This happens to more people than you think because when the stock market is hot, the news trickles down to people like you, and you are the last to know. The time to invest was March of 2020, but that was too scary. As a general rule, the stock market rewards investing when it is scary and does not reward investing when it is safe.

Now, I have no particular view on whether the stock market is on the highs or not. I’m leaning bearish, but my ability to time it is, well—let’s just say I don’t have a lot of confidence in my abilities right now. But it very well could be the top, and I’ve seen some charts of inflows lately that suggest people are indeed piling in at the top. But I’m more concerned about the psychology of a drawdown.

The Psychology of a Drawdown

“It will come back.”

That’s what everyone says: I can take the hit. It will come back.

Then things get a little worse. Just need to be patient. Then things get a little worse.

At this point, you’re researching the stock, rationalizing your losing position. It gets worse and worse and worse. Gosh, I wish I sold six months ago. But it’s too late to sell now.

And it still gets worse…

These days, people have a lot of faith in the idea that the stock market always comes back. And yes, historically, it has always come back. But it may not come back on a time frame that is useful to you.

The market came back after the Great Depression—16 years later! The market came back after the dot-com bust—10 years later.

Imagine if you bought in 1929 or 2000, and you planned on retiring in three years. I mean, if you’re young and launching your investing a career with a huge drawdown, then it absolutely makes sense to keep dollar-cost averaging, because yes, over a 50-year investing career, the market is probably going to come back. Even Japan came back! But if you are close to retirement, you had better not have much in the way of exposure to stocks. If you do, that is just irresponsible. I’ve seen some charts lately that suggest people in their 60s and 70s have the highest exposure to stocks in history.

I think about this because I am actually not too far off from retirement. I just turned 50. If I wanted to, I could retire at age 62. Twelve years! That is not a lot of time. Now, I am not going to retire at age 62, but even if I retire at 70, that is not all that far off. Time to start thinking about de-risking and building a portfolio based around income. I got my 1099s a few weeks ago, and I noticed that I made a substantial amount in money market interest. Enough that I could live off. It got me thinking.

Being Mentally Prepared for Losses

If you are a buy-and-hold type, the market is not going to go straight up and to the right. You will experience drawdowns. If your plan is to ride out the drawdowns and hold on forever, then fine. That is most people’s plan. Everyone has a plan until they get punched in the face.

I prefer to construct a minimum-volatility portfolio so I don’t have to think about these drawdowns. But seeing as how that philosophy hasn’t caught on yet, we’re back to riding it out, which is what Vanguard suggests you do.

Now, I can tell you that I HODL gold like a lot of people HODL stocks. I have been holding it since 2005—19 years—and I plan to keep holding. From 2011–2013, I took a 45% drawdown. No fun. I vowed to myself that I would never do that again. And then in 2022, a 20% drawdown.

But I believe in gold like some people believe in stocks. Some people believe in bitcoin, but I am less sure about that.

Jared Dillian, MFA

|

Dave Ramsey and the One-Size-Fits-All Solution

Usually, when I rank on Dave Ramsey, I get back the following: “Well, he has helped a lot of people, hasn’t he?”

The Coffee Debate: Urine for a Big Surprise

Common financial advice from Suze Orman and other “experts,” like avoiding daily coffee, is wrong. Focus on big financial decisions, not the little things that just don’t matter.

Life Is Too Short to Stay in Cheap Hotels

I was in Boston last week, and usually I stay in the Seaport—the high-rent district.